capital gains tax changes proposed

This is the first of two posts in which well review several proposals that would impact charitable planning by individual taxpayers. Congress could also impose a capital-gains tax at death.

Proposed Tax Changes For High Income Individuals Ey Us

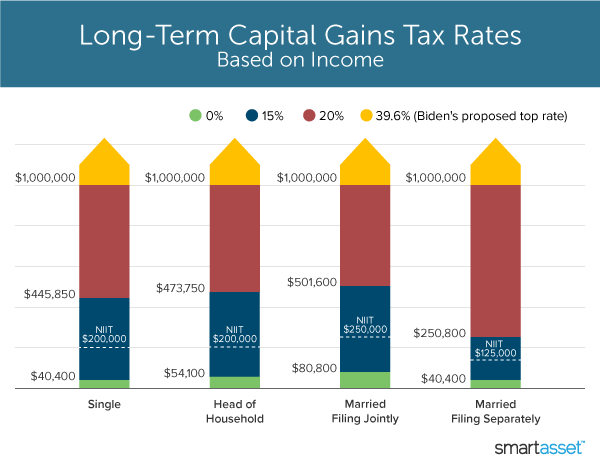

Joe Biden proposes that for individuals with taxable income greater than 1M in a year their capital gains would be taxed as ordinary income under standard income bracketsup to 37 under current tax code and up to 395 as proposed by.

. So heirs that sell property would pay capital gains on the original basis. The new tax laws proposed in April 2021 would eliminate the step-up exemption on any inherited asset that has gained more than 1 million in value between purchase and death. Understanding Capital Gains and the Biden Tax Plan.

The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. These are the current rules but the Biden administration has proposed some changes.

20 on assets and property. These changes may hit homeowners looking. President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20.

What proposed changes to the capital gains tax affect estate planning. Long-term capital gains and qualified dividends are taxed at graduated rates under the individual income tax with 20 generally being the highest rate 238 including the net investment income tax if applicable based on the taxpayers modified adjusted gross income. Were going to get rid of the loopholes that allow Americans who make more.

Today well touch on changes regarding taxes people pay on revenue income and capital gains taxes. The Build Back Better proposal would apply a new surcharge of 8 percentage points to modified adjusted gross income MAGI above 25. The changes in capital gains taxes will also affect the real estate and housing industry.

As part of his presidential platform president Biden has proposed changing the special treatment on income from the sale of capital assets. This could result in a significant increase in CGT rates if this recommendation is implemented. This tax increase applies to high-income individuals with an AGI of more than 1 million.

House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. So the taxes on the. In particular following a Treasury-commissioned review a major proposed increase in Capital Gains Tax CGT has been attracting headlines in recent weeks.

Theres a couple different options here. But President Bidens proposed changes to capital-gains taxes would change that. The top rate would jump to 396 from 20.

10 on assets 18 on property. Nevertheless having a sense of the proposed changes will help in following the debates to come. 13 2021 if passed.

Proposed capital gains tax Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is a steep hike even for the wealthiest among us. The tax hike would apply to households making more than 1 million. The proposed increase in capital gains tax would raise the tax from 20 percent to the highest of 396 percent affecting the wealthiest taxpayers on gains realized after Sept.

These taxpayers would have to pay a tax rate of 396 on long-term capital gains. Proposed changes to Capital Gains Tax. In his April 28th 2021 speech introducing the proposal President Biden explained Ending the practice of stepping.

President Biden will propose a capital gains tax increase for households making more than 1 million per year. The changes in tax rates could be as follows. Currently depending on the nature of the real estate.

First Congress could simply eliminate the step-up in basis. These higher taxes. An increase in Capital Gains Tax while seen as a logical or overdue step by some has caused uproar among many tax observers and business owners.

In the US long-term gains currently face a top marginal tax rate of 238 percent at the federal level the result of a maximum 20 percent capital gains tax rate plus a 38 percent net investment income tax. Already mentioned above this proposed change would almost double the current rate on long-term capital gains which is at 20. The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396.

Raising the top capital gains rate for households with more than 1 million in income. It would apply to those with more than 1 million in annual income according to Bloomberg. Proposed capital gains tax.

Under the proposed Build Back Better Act the top marginal tax rates will jump from. This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. The top rate would be 288 when.

The individual tax rate could just from 37 to 396 for those making more than 400000 annually.

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

Short Term Vs Long Term Capital Gains

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under Th Capital Gains Tax Capital Gain Financial Peace

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How New Capital Gains Rules May Drastically Impact Your Tax Situation

Capital Gains Tax Guide Napkin Finance

It Task Force Proposals May Help Govt Save Inr 55 000 Crore Sag Infotech Capital Gains Tax Indirect Tax Task

Canada Capital Gains Tax Calculator 2022

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Like Kind Exchanges Of Real Property Journal Of Accountancy

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)